different ways to invest your money—mutual funds, CDs, real estate...the

list is seemingly endless. Here's our guide to all the different types

of investments and what they mean.You'll probably come across a handful of terms associated with your investments. We've listed a few of them below. These terms generally

refer to the actual stuff you're invested in, but, of course, they have specific definitions, too. They include:

- Assets: An owned resource expected to increase in value.

- Holdings: The specific assets in your investment portfolio.

- Portfolio:

Your "portfolio" refers to all of your investments, as a group.

Diversifying your portfolio means investing in a variety of assets. - Asset classes: A group of assets with similar characteristics. Generally, stocks, bonds and cash.

investments you own, lending investments, and cash equivalents. Here's

how different investments compare in each of these three categories.

Ownership Investments

that's expected to increase in value. Ownership investments include:

- Stocks: Also known as an equity or a share, a

stock gives you a stake in a company and its profits. Basically, you get

partial ownership of a public company. A large percentage of your

portfolio should probably be made up of stocks. - Real Estate: According

to Investopedia, any real estate you buy and then rent out or resell is

an ownership investment (though it can sometimes be classified as an alternative investment). By their terms, the home you own fulfills a basic need, so it doesn't fall under this category. - Precious objects: Precious

metals, art, collectables, etc. can be considered an ownership-type of

investment if the intention is to resell them for a profit. They also

fall under a separate category, "alternatives." More on that later. - Business:

Putting money or time toward starting your own business—a product or

service meant to earn a profit— is another type of ownership investment.

Lending Investments

repaid. You're sort of like a bank. Generally, these are low-risk,

low-reward investments. This means they're thought to be a safer

investment, but their return is usually low.

- Bonds: "Bond" is a more umbrella term for any

type of debt investment. When you buy a bond, you loan money to an

entity (a corporation or the government, for example) and they pay you

back over a set period of time with a fixed interest rate. Another big

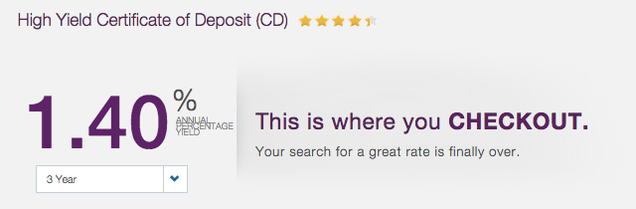

chunk of your portfolio will probably be made up of bonds. - CDs: A

CD, or certificate of deposit, is a promissory note issued by a bank in

exchange for your money. You've probably seen your bank offer these.

They're a type of savings account, but they're a little different.

Instead of taking your money out at any time, you commit to leaving it

in the account for a set period. In return, they'll offer a higher

interest rate based on how long you invest in them.Savings accounts

can also be considered lending investments, if you think about it.

You're giving your money to a bank that loans it out. But your return is

usually pretty low (lower than the inflation rate), so most people

don't consider it a true investment. - TIPS: TIPS

are treasury-inflation protected securities. These are bonds backed by

the US Treasury, specifically designed to protect against inflation.

When your TIPS investment matures over time, you'll get your principal

and interest back, both indexed for inflation. Bogleheads explains how they work in a bit more detail.

in your portfolio to balance things out. The SEC has a helpful beginner's guide to balancing your portfolio.

Cash Equivalents

cash. Cash equivalents are investments that are "as good as cash," as

Investopedia puts it. This might be a simple savings account. It might

be a money market fund. A money market fund is really a type of lending

investment, but the return is so low, it's considered to be a

cash-equivalent investment.

We'll talk about funds more in a bit, but first, let's check out another way to categorize investments—alternatives.

Alternatives

categorized as ownership, lending and cash. Those categories are broad

descriptors, but they're helpful in explaining how different types of

investments work.

But investing companies break things down a little differently. They

go by asset class: stocks, bonds, cash and alternatives. We already know

about stocks, bonds and cash—the most traditional ways to invest. In

terms of asset class, alternatives are everything else. Consequently,

much less of your portfolio should be invested in them.

Also, it's easy to categorize some investments alternatives, because they could actually be considered ownership or lending investments, depending on how they're bought. But let's take a look at some examples.

REITs: Real Estate Investment Trusts, or REITS, are another way to invest in real estate. Instead of buying your own property, you work with a company that earns profit from their own real estate investments.

Really, an REIT can be an ownership investment or

a lending investment, depending on what type you buy. You can buy an

REIT that gives you a share in the real estate itself. This would count

as an ownership investment. Investopedia explains

When you buy a share of a REIT, you are essentiallyBut you could also invest in the mortgage of the real estate, which would make it a lending investment.

buying a physical asset with a long expected life span and potential for

income through rent and property appreciation.

Venture Capital: This is money you give to a startup

or small business, with the expectation that it will grow, and you'll

get a return on that money. A lot of times, venture capitalists become

partners in the company, owning part of a its equity and getting a say

in business decisions. In this way, they can be thought of us ownership

investments.

Commodities: Investing in a commodity is investing

in some sort of resource that affects the economy. Oil, beef and coffee

beans are all different types of commodities. The contracts you use to

buy these goods are called Futures Contracts, and you have to fill them

out through a National Futures Association broker, MarketWatch explains.

Precious Metals: Like we mentioned earlier, metals

and collectables are, technically, ownership investments. You own the

gold you're buying, for example. But it's not a stock or a bond, so

most people refer to it as an alternative.

Funds

They're not specific investments, but a general term for a group of

investments. The Guardian defines investment funds as:

...a pool of money which is professionally managed toBasically, an investment company picks a collection of similar assets

achieve the best possible return for investors. When money is paid in

the manager uses it to buy assets, typically stocks and shares.

for you. It can be a group of stocks or a group of bonds. Or, the fund

can be even more specific—there are funds made up of all international

stocks, for example. In return for their curating your investments,

you'll pay a fee, or an "expense ratio." But they aim to be a more

convenient investment, with picks that provide a better return than

anything you would probably pick on your own.

Let's check out the different terms associated with funds.

Mutual Funds: A mutual fund is, basically, another

term for investment fund. To provide a more formal definition, here's

how Investopedia explains it:

An investment vehicle that is made up of a pool of fundsIndex Funds: A type of mutual fund meant to mirror the return of a specific market, like the S&P 500. Get Rich Slowly offers a thorough piece on index funds, and they explain them as:

collected from many investors for the purpose of investing in securities

such as stocks, bonds, money market instruments and similar assets.

Mutual funds are operated by money managers, who invest the fund's

capital and attempt to produce capital gains and income for the fund's

investors. A mutual fund's portfolio is structured and maintained to

match the investment objectives stated in its prospectus.

Index funds are mutual funds, but instead of owning maybeBecause they're meant to mirror the market, index funds are

twenty or fifty stocks, they own the entire market. (Or, if it's an

index fund that tracks a specific portion of the market, they own that

portion of the market.) For example, an index fund like Vanguard's VFINX, which attempts to track the S&P 500 stock-market index,

tries to own the stocks in its target index (the S&P 500, in this

case) in the same proportions as they exist in the market.

"passively managed", which means there isn't a team of investors

constantly analyzing, forecasting and adjusting the assets in the fund

(known as active management). As a result, they tend to have lower expense ratios, which means you keep more of your money.

Exchange Traded Funds (ETFs): These are very similar

to index funds in that they're meant to track an index, or a measure of

a specific market. The biggest difference is the way they're traded.

ETFs can be traded like stocks, and their prices adjust like stocks

throughout the day. Mutual and index funds don't work this way. ETF

Database further explains:

The biggest difference between these two products is theHedge Fund: Hedge funds are like mutual funds, with a

frequency with which they are priced and traded. Index mutual funds are,

after all, mutual funds, and as such they are priced once a day after

markets close. ETFs–including both active and passive ETFs–are priced

throughout the day, and can be bought or sold whenever the markets are

open.

few very important differences. First, they're not regulated by the

U.S. Security and Exchange Commission (SEC). They're also considered

riskier than regular mutual funds, because their assets can include a

broader range of investments. Also, they often use borrowed money to

invest, as BarclayHedge explains. To learn more about hedge funds, check out Investopedia's full explanation of them.

With so many terms associated with investing, knowing what exactly to

invest in can seem complicated. But once you organize these terms into

categories, they're actually pretty easy to understand.

Photos by: Tina Mailhot-Roberge, Tax Credits, bfishadow, Ron Wolf and Howard Lake.

He is no scam,i tested him and he delivered a good job,he helped me settle bank loans,he also helped my son upgrade his scores at high school final year which made him graduate successfully and he gave my son free scholarship into the college,all i had to do was to settle the bills for the tools on the job,i used $500 to get a job of over $50000 done all thanks to Walt,he saved me from all my troubles,sharing this is how i can show gratitude in return for all he has done for me and my family

ReplyDeleteGmail; Brillianthackers800@gmail.com

Whatsapp number; +1(224)2140835